Never Miss a Tax Notice or Deadline Again

Automate tax notice intake at scale, streamline resolution workflows, and keep a clean audit trail.

Automate tax notice intake at scale, streamline resolution workflows, and keep a clean audit trail.

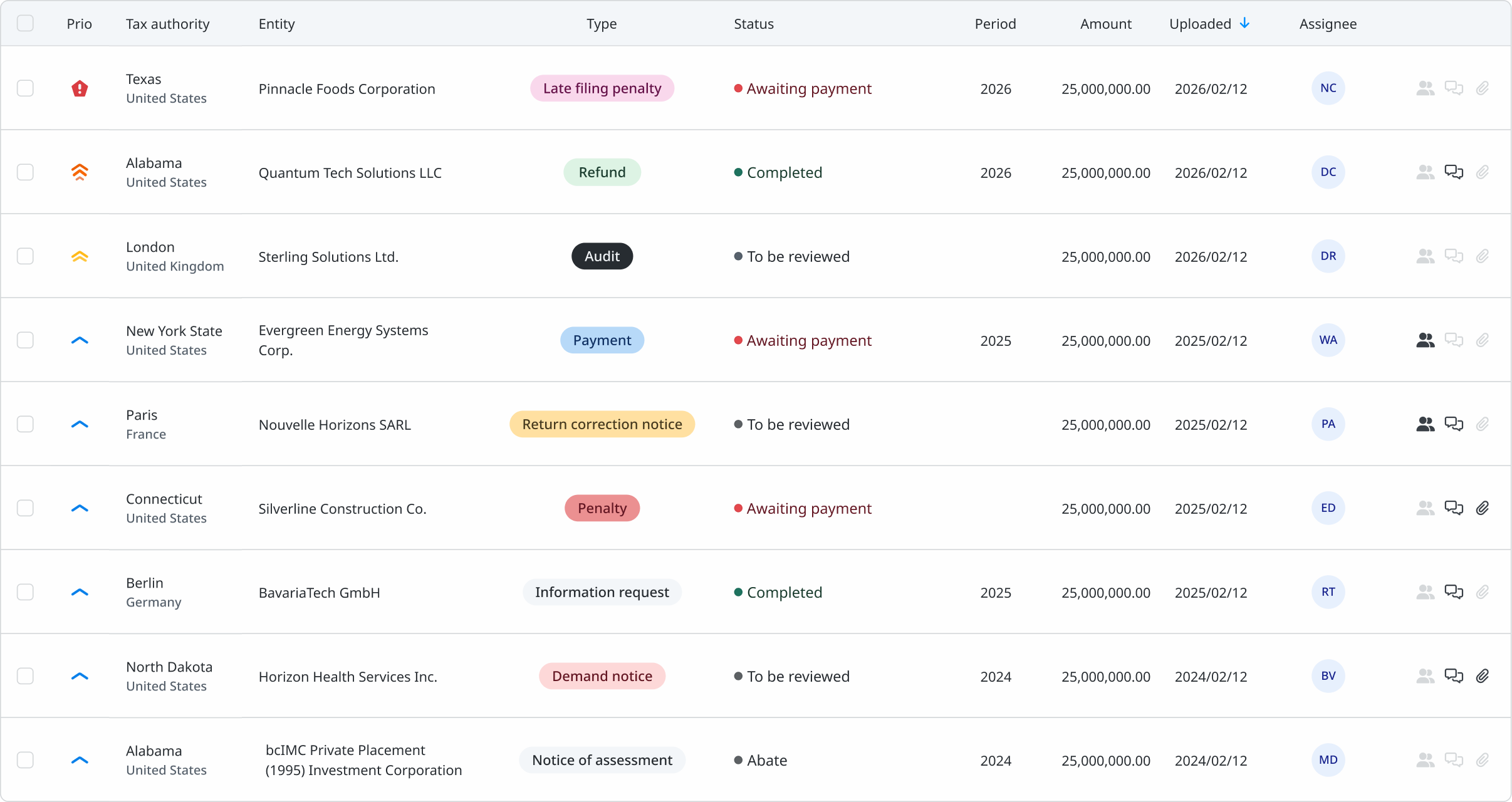

Automate notice intake and organization to eliminate manual handling.

Automated tracking and reminders keep every notice and due date visible.

All notices, actions, and decisions are captured in a single, searchable system.

Every action and update is recorded in a clear timeline.

Noticehub has transformed the way we handle tax notices by providing a centralized platform for our team. It streamlines the upload, categorization, and review process, allowing us to act faster and with greater accuracy across jurisdictions.

Amelia Staton

Indirect Tax Analyst

TDW (US) Inc.

Noticehub provides us with a central place for the tax team to upload and manage the many notices that we receive from tax authorities globally. It is able to quickly read and interpret each notice and organizes them for easy review and action across the team.

Derek Chan

Former Managing Director, Tax

Northleaf Capital Partners

Drag and drop your scanned tax notice PDFs onto the dashboard, whether single, in batches or even multiple notices in one PDF file.

Multiple notices will be separated and translated if necessary, with key data extracted in seconds.

Extracted data includes tax agency info, taxpayer info, tax periods, tax types, notice types, due dates, and amounts.

User reviews are encouraged to confirm accuracy. Although best-in-class AI is used for data extraction, it is not infallible.

Add documents, annotate notices and assign tasks within your team. Each action is logged and timestamped for transparency.

Stay informed with customizable email notifications for upcoming due dates and new task assignments.